which are prepaid costs when buying a home loan fees

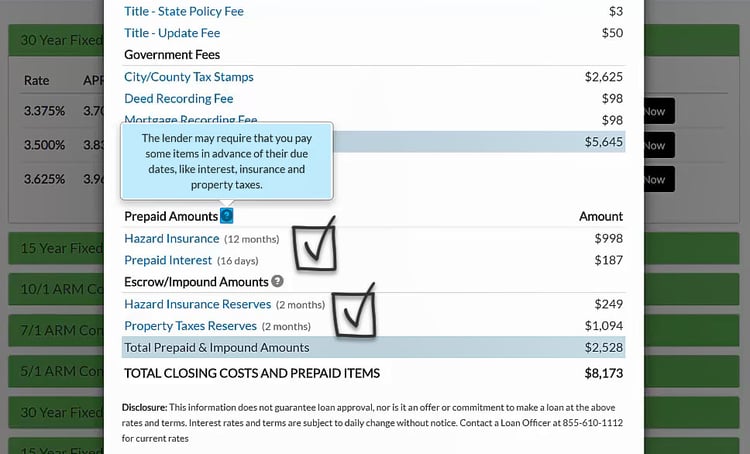

Prepaid costs usually include the homeowners insurance premium mortgage insurance premium if applicable property taxes and prepaid interest fees. Upfront expenses home buyers must pay before closing on a home.

Prepaid costs are estimated fees for property taxes interest on your mortgage and homeowners insurance premiums.

. You dont have to be confused by prepaid loan costs. Prepaid costs can includes are. Prepaid costs are the homeowners insurance mortgage interest and property taxes that you pay at closing when you buy a home.

The equivalent of which are prepaid costs when buying a home. The prepaid in prepaid costs doesnt. Prepaid costs contribute to upfront mortgage expenses like insurance and taxes.

The most common kinds of prepaid costs are homeowners insurance property taxes and mortgage interest. However much of the fees are prepaid interest taxes and insurance for your escrow account. Prepaid costs when buying a home or prepaids are expenses that you would pay for anywayyoure just paying for them early.

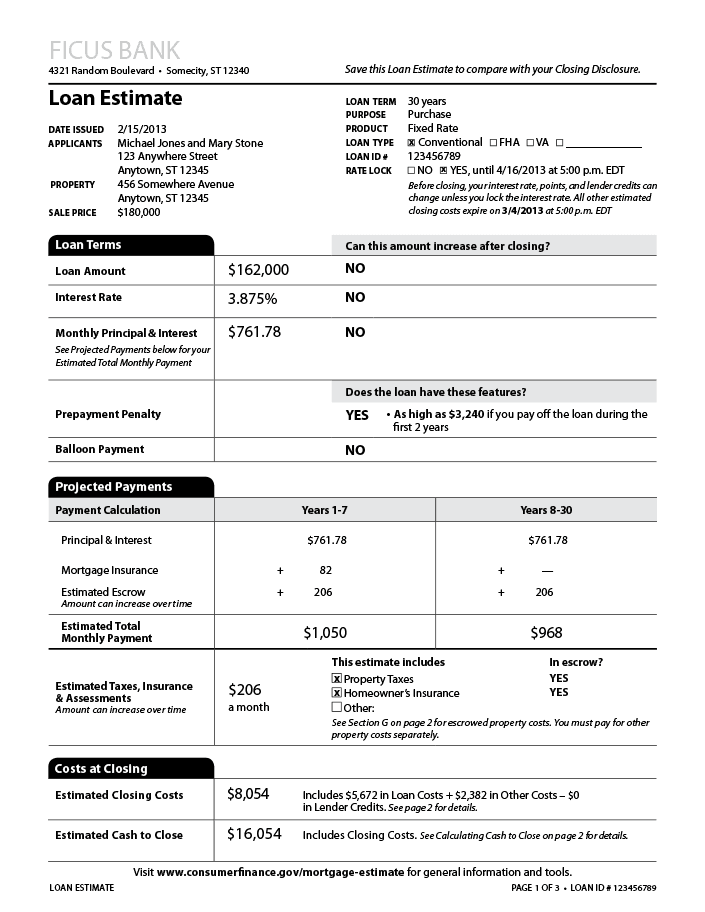

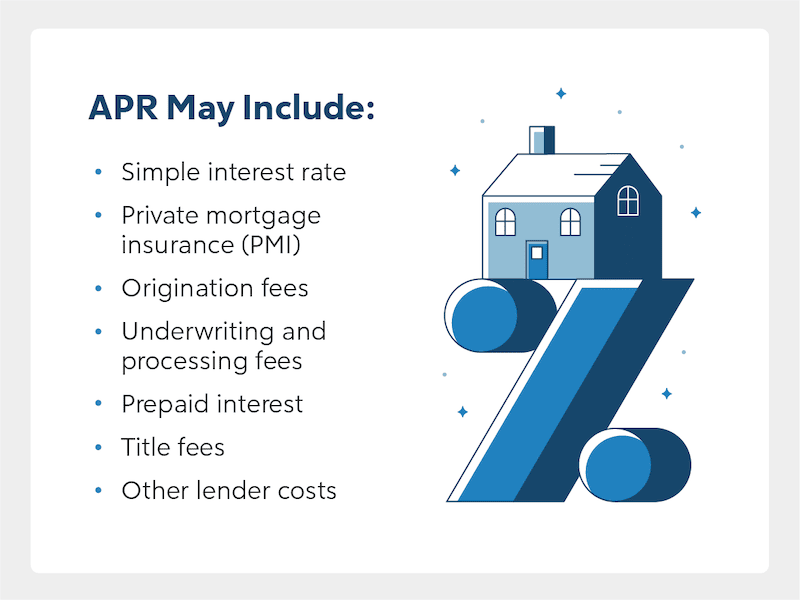

You can expect to pay one to two percent of the purchase price in closing costs. Get a home loan can be tricky. Prepaid finance charges can include such things as administration fees origination fees and loan insurance.

The costs may also include mortgage insurance premiums. When considering closing costs vs prepaid fees a big difference is prepaid fees are associated with the home rather than the real estate transaction. Since these expenses are not a part of the asking amount they are considered to.

A minimum amount may be required based on the loan amount and loan type you choose. Closing costs on the other hand are associated with the origination and closing of your. Although the home seller will sometimes cover closing costs as part of the sale agreement the buyer always pays the prepaid costs when buying a home.

Prepaid costs typically include homeowners insurance mortgage insurance if applicable property taxes and prepaid interest fees. Prepaid costs are for home-related expenses that you will need to pay regularly mortgage interest homeowners insurance mortgage insurance and property taxes. And who do t.

And all the costs involved are confusing. Arent they just prepaid closing costs Prepaid costs closing costs and escrow are separate expenses. Which Are Prepaid Costs When Buying A Home.

Mortgage companies are required to provide you. These are paid into an escrow account to ensure that you have money to. Closing costs are fees for services rendered during.

What Are Prepaid Costs When Buying A Home

What Is Simple Interest How To Calculate It For Your Home Loan Quicken Loans

Cost Of A Prepaid Loan Home Nation

How Much Money Do You Need To Buy A House

Closing Costs In California Explained

What Are Prepaid Costs When Buying A Home Mashvisor

:max_bytes(150000):strip_icc()/shutterstock_299702729_closing_costs-5bfc3181c9e77c0026317a8f.jpg)

Understanding Mortgage Closing Costs

/buyer-s-closing-costs-1798422-final-3054a11ea59a4f3d9877de662819234b.png)

Closing Costs For The Buyer How Much Are They

Cost Of A Prepaid Loan Home Nation

What Are Prepaid Costs When Buying A Home Matt O Neill Real Estate

Which Fees Are Prepaid Costs When Buying A Home Rocket Mortgage

Is There A Difference Between Prepaids And Closing Costs

Closing Costs What Are They And How Much Will You Pay Ramsey

Mortgage Closing Costs Vs Prepaids Bankrate

Prepaid Items Mortgage Escrow Account How Much Do They Cost

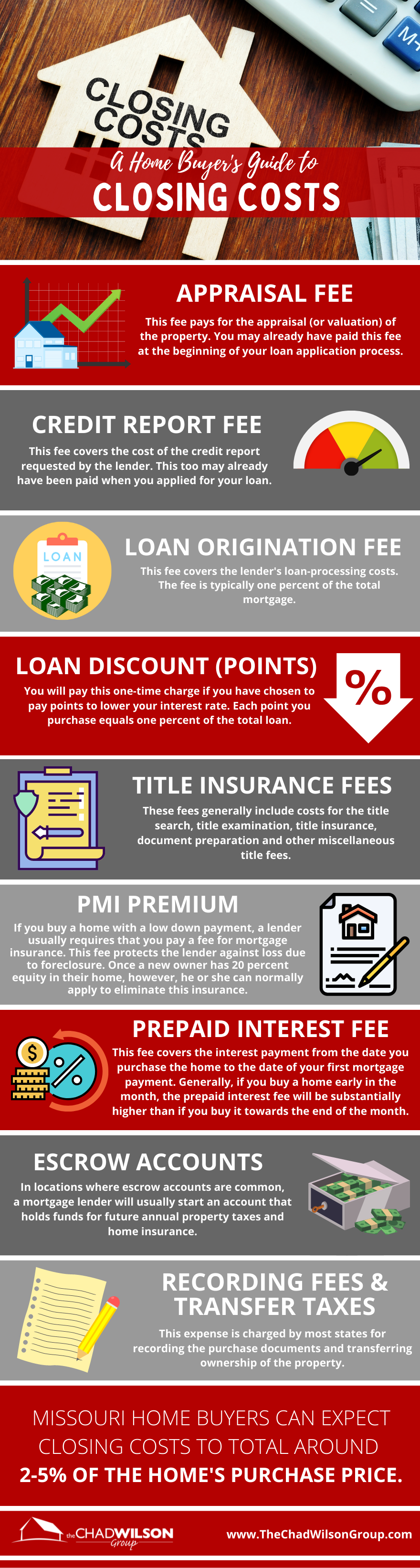

A Home Buyer S Guide To Closing Costs Infographic